WGP is an independent sponsor focused on acquiring and scaling essential service businesses in the lower middle market. Our approach is disciplined, founder-friendly and built on long-term value creation.

WGP is an independent sponsor focused on acquiring and scaling essential service businesses in the lower middle market. Our approach is disciplined, founder-friendly and built on long-term value creation.

We target resilient lower middle market businesses with strong fundamentals and clear opportunities for growth. Guided by a thematic investing approach, we focus on essential service sectors and partner with management teams to unlock value through operational expertise and disciplined execution.

Revenue: $5-50mm

EBITDA: $1-10mm

Succession, management transitions, recapitalizations & carve-outs

Majority/control

investments

U.S.-based, with preference for high-growth population markets

Buy-and-build strategies, operational improvements, durable growth platforms

Flexible structures designed around owner goals and succession needs

Hands-on support, aligned incentives and collaborative decision-making

Disciplined consolidation in fragmented service markets

Flexible structures designed around owner goals and succession needs

Decisive execution

without bureaucracy

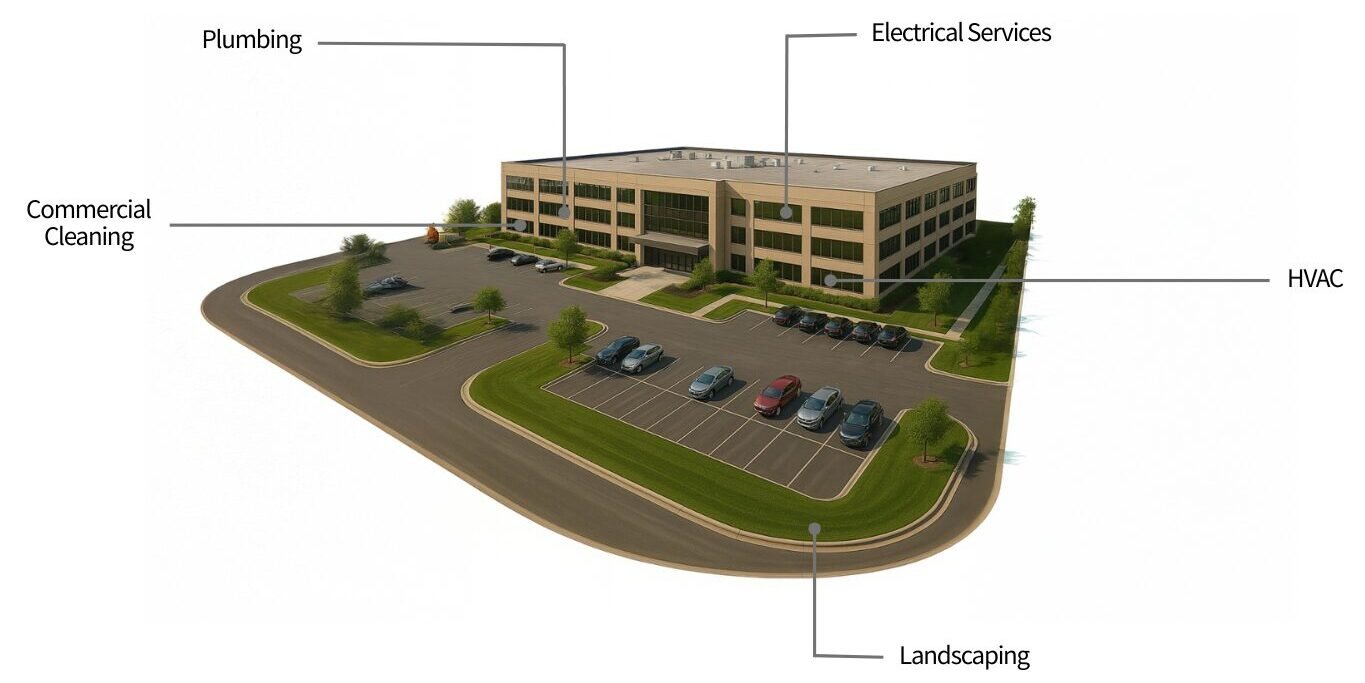

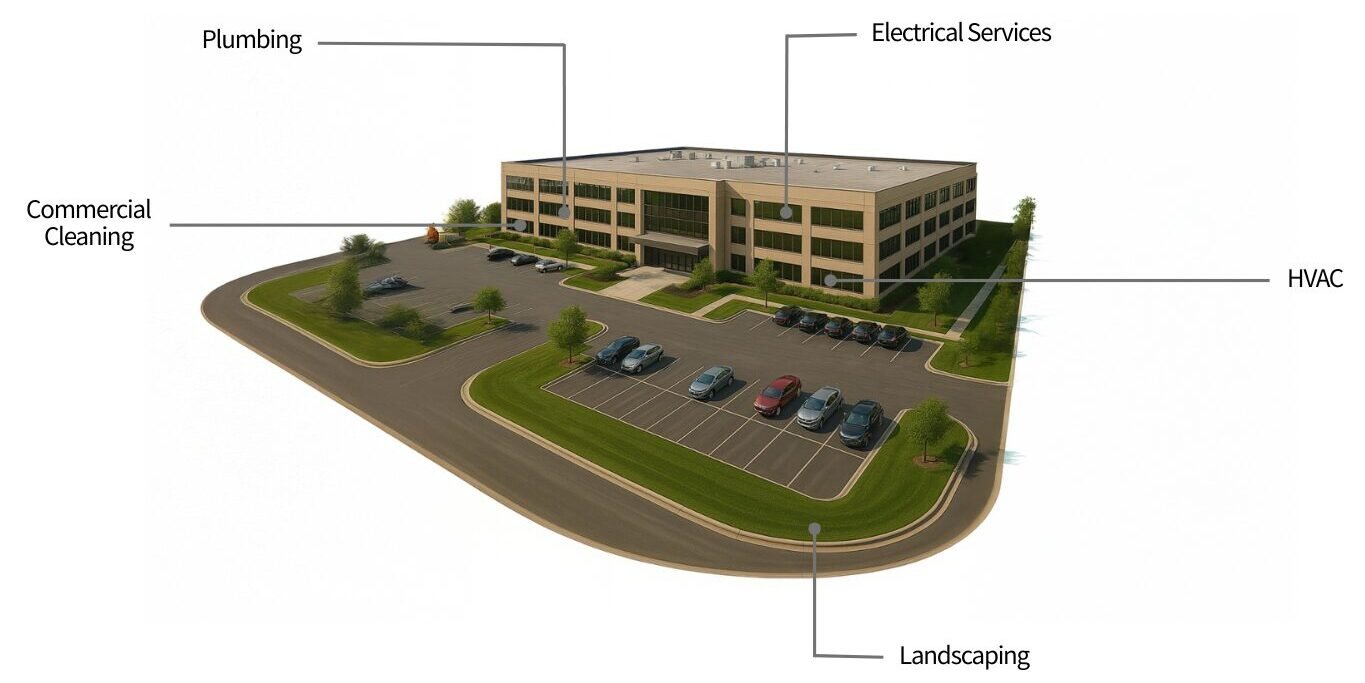

We invest across essential residential and commercial services that touch people’s daily lives. Our strategy emphasizes disciplined buy-and-build platforms, cross-sell opportunities and operational integration that expand market presence and strengthen companies.

This dual focus allows WGP to consolidate within individual service verticals while driving cross-sell opportunities across complementary markets.

This dual focus allows WGP to consolidate within individual service verticals while driving cross-sell opportunities across complementary markets.

WGP brings hands-on expertise to help companies grow and scale. We partner with management on critical areas such as pricing, sales, operations and add-on integration — driving sustainable revenue growth and long-term value creation.

Companies Scaled*

Of Revenue Created*

Of Advised Transaction Value*

Of Combined Experience*

*Represents the experience of the team, not all of which occurred at WestGate Partners LLC.

WGP invests in service sectors such as landscaping, pool and commercial cleaning, pest control, HVAC, plumbing and electrical services. These businesses provide everyday services that keep homes and communities running.